A big headline is making waves this week: Google Pay is reportedly launching in Bangladesh next month. At first glance, it sounds like a major win for our digital economy. But if you’re like most people, you’re probably asking:

“Didn’t we already have digital payments?”

“Will this be any different from bKash or Nagad?”

“Can I finally send money from abroad using Google Pay?”

Let me break it down simply—and share my view on what it really means (and doesn’t).

What’s the News?

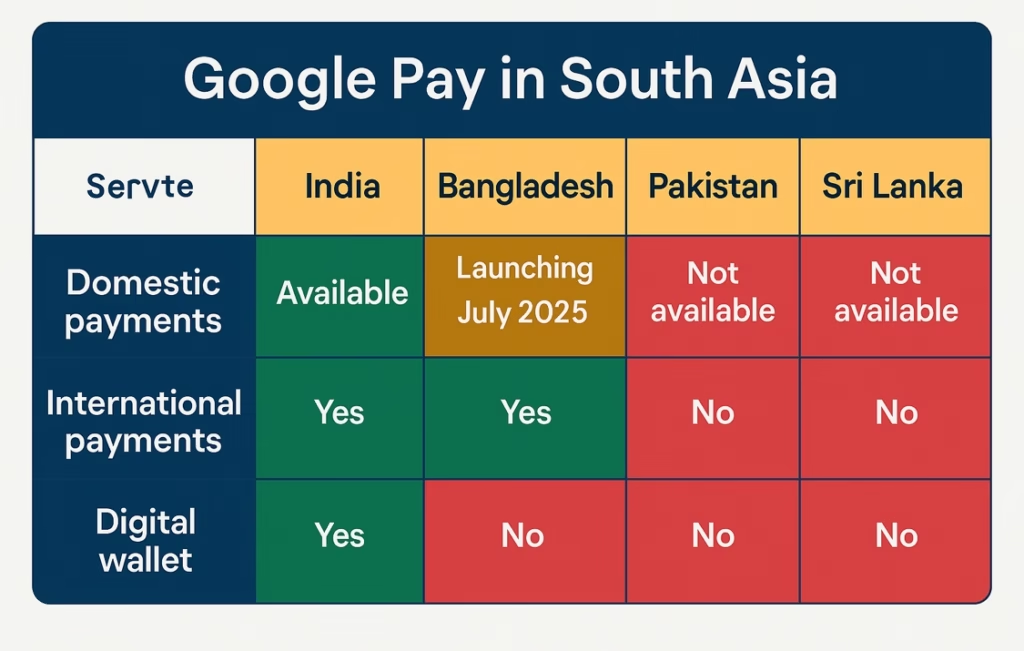

According to Asif Mahmud interviewed on The Business Standard, Google Pay will officially enter the Bangladeshi market by July 2025, partnering with banks and local authorities. The BTRC (Bangladesh Telecommunication Regulatory Commission) and ICT Division have reportedly fast-tracked the approval process.

Why This Feels Like a Big Deal

Google is a global brand. The name alone signals trust, innovation, and global access. The platform could allow faster payments, smoother Android integration, and possibly cross-border potential down the line. For the local fintech ecosystem, it brings a new standard—and likely competition for our homegrown giants like bKash, Rocket, and Nagad.

But Wait—Let’s Be Real

Despite the hype, Google Pay’s local launch doesn’t mean you’ll be able to:

Send money from the U.S. or UK to Bangladesh via Google Pay Use it as an international wallet (like PayPal or Wise) Expect a universal payment revolution overnight

Instead, it’s likely a localized version, tied to Bangladeshi bank accounts, and limited to domestic payments only—at least for now.

My Take: Strategic Move, But Not a Gamechanger—Yet

This is a symbolic win, not yet a systemic shift.

Brand Boost: It improves confidence in Bangladesh’s tech landscape. Having a tech giant like Google launch a product here sends the message: “We’re ready.” Digital Ecosystem Maturity: If properly executed, this could push banks and local players to raise their UX and security game. Think smoother QR payments, unified merchant systems, and better Android app experience. But No Shortcut to Remittance Revolution: Let’s not confuse this with a PayPal-style solution. Unless Google enables global wallet interoperability, this remains a fancy domestic app with a global logo.

What Bangladesh Must Do Next

If we truly want to benefit from global digital platforms like Google Pay, we must:

Reform our cross-border payment regulations Create a one-stop fintech sandbox for innovators Push for Open Banking APIs and wallet interoperability Stop blocking platforms like PayPal under outdated licensing excuses

Final Words

Google Pay’s launch is a positive signal, but we must not celebrate too early. Without policy reform and ecosystem readiness, this could just be another logo slapped on top of the same old system.

Let’s welcome it, yes. But let’s also stay clear-eyed about what really needs to change—so that the next big announcement actually changes lives, not just headlines.